Money transfer at any time of day, every day of the year, within seconds.

It can be used when paying at brick-and-mortar points of sale and for online purchases, and even when paying utility bills or paper payment orders. The only payment manner that makes the money instantly available to the payee.

IPS payment at the point of sale

Show and pay

payment by IPS QR code

The IPS SHOW option is in your m-banking app.

You need to launch the IPS SHOW option from the m-banking app’s home page and generate the IPS QR code, which you then need to show to the merchant.

The merchant will scan the code and the payment will automatically be made.

SHOW in the m-banking

app

your PIN or

fingerprint

to the merchant

complete

IPS payment at the point of sale

Scan and pay

payment by IPS QR code

The IPS SCAN option is in your m-banking app.

You need to launch the IPS SCAN option from the m-banking app’s home page and scan the IPS QR code which the merchant has previously generated on its device.

Confirm the transaction after scanning the code and the payment will automatically be made.

in the m-banking

app

IPS QR code

or fingerprint

complete

IPS payment online

payment by IPS QR code

Select IPS SCAN in the m-banking app

Scan the merchant’s IPS QR code

Confirm with your PIN or fingerprint

Payment

complete

On the web page where the purchase is being made, select IPS SCAN as the manner of payment. Once the generated IPS QR code is shown on the web page, select the IPS SCAN option in your m-banking app and scan the shown IPS QR code.

When making an IPS payment online, we especially emphasize that, as a payer, you do not leave any information about your payment instrument online; rather, by scanning the merchant’s IPS QR code, you download the data necessary for making the payment.

Soon, IPS online payments will be enabled with just one click on the mobile phone.

in the m-banking

app

IPS QR code

or fingerprint

complete

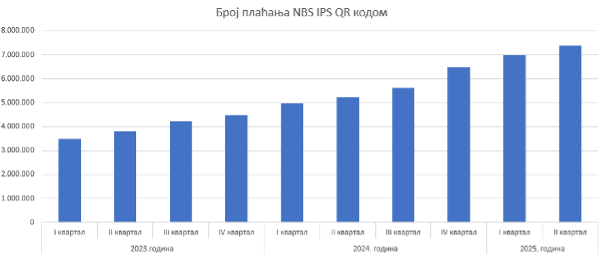

NBS IPS QR code for paying utility bills

payment by the NBS IPS QR code

Select IPS SCAN

in the m-banking

app

Scan the

NBS IPS QR code

The payment order is automatically filled in, but you can still make changes to it. Confirm with your PIN or fingerprint

Payment

complete

By using the NBS IPS QR code, you can pay your bills (for utility and other services) within seconds.

Look for the NBS IPS QR code on the bill, scan it using your m-banking app and pay the bill.

This is an efficient and reliable method that does not require you to retype the data, or to use templates in e-banking and m-banking apps.

in the m-banking

app

NBS IPS QR code

but you can still

make changes to it. Confirm with

your PIN or fingerprint

complete

IPS – electronic and mobile banking

Payment without the IPS QR code

Fill in the order and select IPS payment – “Urgent”

The money will be transferred to the payee instantly

If you want to make an instant payment via electronic or mobile banking, you need to select the option for the emergency (instant) order.

If there is no such option, it means that your bank performs all orders as instant payments via the NBS IPS system.

IPS payment – “Urgent”

to the payee instantly